The History of Foreign Exchange

The words foreign and exchange when put together in a sentence sound all-together daunting. Don’t they?

Almost like a subject taken all on its own during Second Year in a B. Com Economics. Or something along those lines. A topic you need to seriously study in order to simply grasp the basic concept of.

It’s intimidating and for a lot of people – easier left to the experts.

With theory’s like the so-called Big Mac Index to (in a more lighthearted, colloquial way) describe the concept of “purchasing power parity” and how exchange rates work to the every-day person. To why the almighty US Dollar has such an effect on global markets.

There is a lot to take in.

While the concepts mentioned above have something to do with foreign exchange, they are not all-encompassing, nor do they truly tell you what foreign exchange (or forex) is. Or, where it comes from.

And let’s be honest, how many of us have really stopped to think about forex? Really? Only a handful, we wager. Again, rather leaving the whole ordeal to the experts.

Like us at Kuda FX.

But instead of simply turning a blind eye, believing ignorance to be bliss, we believe industry knowledge is crucial. Especially if you are looking to invest offshore, import something nice or purchase forex for your own personal use.

Therefore, in an effort to educate (and help) our valuable clients (and anyone else) itching to find out a little more about forex, we thought we would shed some light on where it all started. Just to get the ball rolling (so to speak) ….

Because at Kuda FX we pride ourselves on knowing all the ins and outs of forex (or even FX as it’s called). It’s (literally) what we do. In fact, it’s in our name.

So, without further ado – let’s find out how the forex market started.

Is the forex market, really a “market”?

Actually, yes.

The forex market is one of the original (and oldest) financial markets in history.

Centuries old – the forex market can be dated as far back as the Ancient Babylonian’s (around 2000 BC).

Today, the forex market, is “one of the biggest, most liquid and accessible markets in the world, and has been shaped by several important global events, like Bretton woods and the gold standard” (Daily FX).

But the question is – where did it all come from?

Well, in order to understand where forex came from, it’s important to understand how the world got methods of exchange in the first place.

- a method of exchange is the instrument or system used to facilitate the sale, purchase, or trade of goods between parties (Investopedia).

A brief history of methods of exchange

It all started with the barter system.

As the oldest method of exchange, beginning around 6000BC, the barter system was introduced by ancient Mesopotamia tribes. It allowed merchants to exchange goods for other goods. But as things always do, they evolved. And the once straight forward barter system moved away from simply exchanging one thing for another thing and instead started to involved the exchange of an item for something else. Salt and spices suddenly became the popular “go-to” mediums of exchange.

And this meant that traders could – instead of bartering one cow in exchange for a horse (as an example) – could now trade that same cow for a bag of salt or even exotic spices.

This became the new normal. As was often the case back then, merchant ships from all over the globe would sail off to faraway lands in order to barter their ships haul for exotic spices.

Beginning the first ever form of foreign exchange.

Then as early as the 6th century BC, there was a further development – the first currency was developed. Currency in the form of gold coins was produced by the Ancient Greeks. The value of this currency was derived from the weight and size of the gold coin (which makes sense actually). And because these coins were easily portable, durable, divisible (because they had a value), and had a limited supply (due to the supply and availability of gold) these coins made for the perfect form of currency which then enabled further trade amongst nations.

As time moved on, gold coins became the most accepted medium of exchange. Most countries around the world adopted the practice of “paying” for an item or many items with gold coin. And this carried on for some time…

But there was one itty-bitty problem – gold is heavy. Traders found they couldn’t trade as many items for the gold they were able to carry.

And that led to the trade with gold becoming more and more impractical. And expensive.

So, during the 1800’s instead of trading with actual gold coin, the so-called “gold-standard” became the go-to measure as far as trade was concerned.

The gold standard was a monetary system where a country’s currency (their paper money) had a value that was directly linked to the value of gold at the time. With the gold-standard as the now accepted form of trade, countries agreed to convert their paper money into a fixed amount of goldin order to ensure a fair and just rate of exchange (Investopedia)

And the effect of this? The gold-standard guaranteed the value of a particular currency. And because of how well this worked, the forex market, was intrinsically linked to the gold-standard. By the 1900’s, countries could freely (for the most part) trade with one another because their currencies could be converted into gold.

The gold-standard was the very thing that formed the backbone of the forex market. Then.

That’s until WWI when it had to be suspended so that more paper money could be printed to pay off the war debt….. war is expensive.

Ok. But how did the forex market start?

Now that we understand how the value of a currency was established, let’s chat about where the forex market began…..

It has been said – by a few sources (the Amsterdam Red Light District (ARLD), Equiti and ATFX, amongst others) – that the first official forex trading started in Amsterdam as far back as 1493 in the streets of Warmoesstraat (close to the harbour).

It is rumored (in an actual historical document) that traders would meet every day “on the north of the street” to trade. There was no bricks and mortar building that could be called “the foreign exchange market”, but the traders – happy in their “trade” – were satisfied with simply operating in an “open air market”. Easy-breezy.

But it was in 1592 that Amsterdam’s city council passed a by-law ensuring that market trading was done in an “orderly fashion”. Very formal, wouldn’t you say? A few years passed by and then in 1602 Amsterdam could be seen as the first official “hub” for forex trading – in fact, it was the Dutch East India Company that according to the Amsterdam Red Light District –

“was the first company in the world to issue shares to the public at large. This was the beginning of the worldwide trade in shares. Investors from all walks of life were invited to buy shares. In 1606, they were given depositary receipts for their investments; these are now regarded as being the first shares ever issued. It was revolutionary change. Investors could recuperate their money by selling their shares, however their investment still formed part of the company’s capital. The VOC managed to double money, literally.”

In 1611, Amsterdam’s first commodity exchange officially took place. The foreign exchange building named the Hendrick de Keyser Exchange for the architect who designed the building, was built on the Southern side of Dam Square, over five arches stranding the city’s Rokin canal. And it was here that traders did most of their “trading” involving commodities (like gold).

And that was only the very start of forex trade……

How has the forex market changed since Amsterdam?

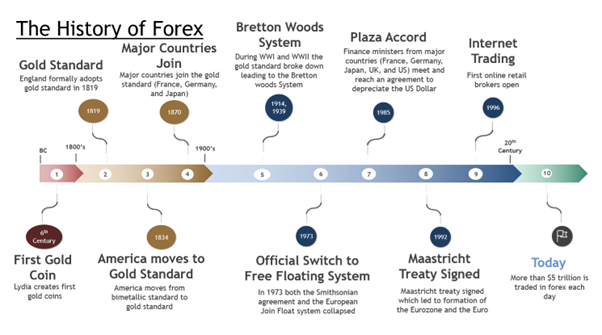

Of course, the forex market has changed substantially over the years (and since the advent of the gold-standard). The market has (wisely we might add) adapted to how the world works – through each age. To illustrate this statement, there are 5 main world events that contributed to the development of the forex market and how we trade in forex today. They include –

- Bretton Woods System which created the International Monetary Fund and World bank, was an agreement where gold would be the basis for the U.S Dollar and all other currencies would base their value by comparing it to the U.S. Dollar. Bringing about the quote “When America sneezes, the world catches a cold” (you can read more on this quote here). The Bretton system finally dissolved in 1973.

- Free floating system – a monetary system in which exchange rates are allowed to move due to market forces without intervention by country governments. This free-floating system did however allow for a greater fluctuation band for currencies. The United States pitched the dollar to gold at the exchange rate of $38/ounce, thereby depreciating the dollar. But by the end of the early 1980’s, “the weight of the US dollar was crumbling the economies of the third-world nations under debt and closing most European factories because they could not compete with other foreign competitors” (ATFX). A further reform was needed.

- The Plaza Accord – it was then in 1985 that an agreement among the most powerful nations in the world – the G-5 nations (France, Germany, the United States, the United Kingdom, and Japan) —was reached to manipulate exchange rates by depreciating the U.S. dollar relative to the Japanese yen and the German Deutsche mark. Also known as the Plaza Agreement, the intention of the Plaza Accord (as it is also referred to) was to correct trade imbalances between the U.S. and Germany and the U.S. and Japan. However, it only had the effect of correcting the trade balance with the U.S. and Germany.

- Maastricht Treaty – signed in 1992 in Maastricht, the Maastricht Treaty is seen as the foundation for the European Union (EU), further paving the way for a single currency to be used within the EU, the Euro.

- Internet trading – starting in the 1990’s “internet trading” began as many dealers and brokers of the forex market started to develop their own trading platforms, intended to simplify and accelerate the process of trading. Today, almost all brokers use the internet to access trading on Forex, Stock and Commodity markets and electronic marketplaces, giving traders the opportunity to make real-time transactions independently. It’s all very fast-paced and exactly what you think about when you hear the term “traders” on the stock exchange.

Image Source: Daily FX

And that’s the brief history of forex and forex trading – in a nutshell. But, believe us, it’s not everything.

There is so much more we want to share with you! The topic of forex is (truly) fascinating.

In fact, next month we will be discussing some basic terminology with you (so that you can fully grasp everything forex related) as well as how the value of a currency is determined – is it just typical supply and demand or is it based on other factors?

Sound interesting? Tune in next month for some more of our “forex tidbits”.

In the meantime, if you have any queries on the information we have set out above, or if you require assistance with your own forex needs, please feel free to get in touch with us. We cannot wait to help you with all your forex needs! Kuda FX has you covered!